What is Trade-Based Money Laundering (TBML)?

Publication date 13-05-2019

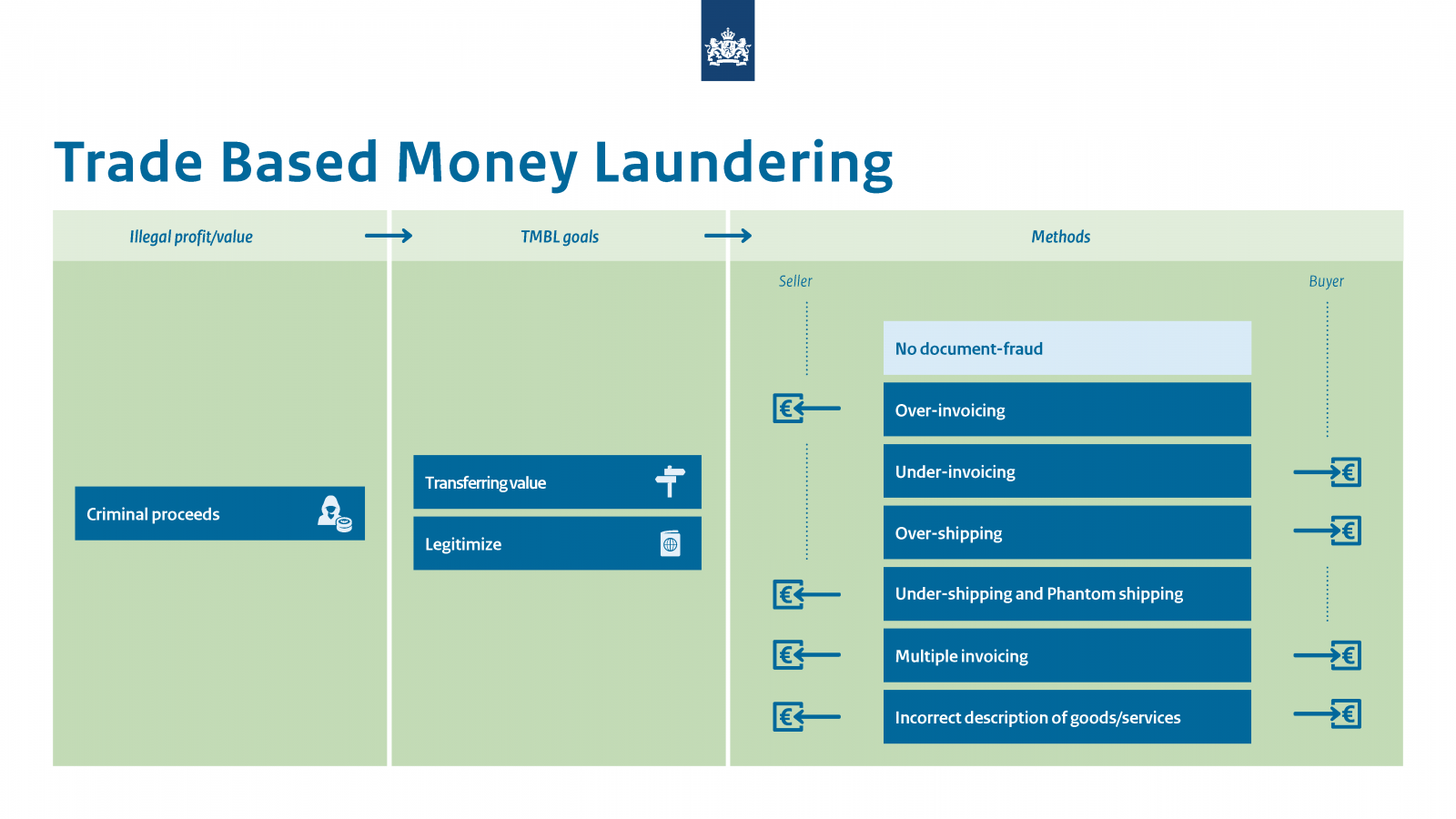

Trade Based Money Laundering is the use or setting up of commercial structures for the purpose of laundering criminal money. We are not talking about one-off events here, but about well organised constructions which are designed to facilitate the laundering of millions. According to the Financial Action Task Force (FATF) the following minimum conditions must be fulfilled before the activities in question can be regarded as TBML :

- Criminal profits/value must be involved;

- There must be a view to relocation of that value by means of products or services which are traded;

- That relocation must lead to the realisation of a form of legitimacy. The criminal money must acquire an ostensibly ‘clean’ status.

There is (so far) no consensus about the definition and scope of TBML. There is a debate, for example, as to whether the misuse of domestic (and not just international) trade should also be classified as TBML.

For many manifestations of TBML there is some sort of document fraud involved;

- Over-invoicing and under-invoicing

- Over-shipping and under-shipping

- Phantom shipping (invoices sent but nothing actually shipped)

- Multiple invoicing

- Incorrect description of goods/services

Advanced indicators are needed to detect these forms of TBML. Is the route followed by the goods logical? Is there a real demand for the exported goods in the sales area? Is it an intra-Community delivery? Are there tax advantages to be acquired? Are sanctions avoided? Is the price paid in line with the market? Are financing products deployed? If so, does it make sense to do so? These are just some of the challenging questions that need to be answered for every suspicion. The questions vary for each sales area, product type and sector.

This year we have seen a new manifestation of TBML whereby the goods are actually transported, the prices paid are in line with the market and the goods are correctly invoiced. The problem with this form of TBML is the enormous quantities of cash for which the goods are purchased prior to their relocation. This form is referred to as ‘cash integration’. As well as being a major player in international trade the Netherlands is a very large player when it comes to the production and trafficking of drugs. This generates huge amounts of cash on a daily basis. Cash which criminals then set out to launder, using (among other things) TBML constructions to do so.