Mirror trading, an opportunity for criminals?

Publication date 04-12-2020

By Dorine Stahlie and Sophie de Ridder, AMLC

In response to the FinCen files, several news items were published on mirror trading in connection with money laundering. Take for example the item in the FD [Dutch Financial Newspaper] entitled: ‘Hoe miljarden uit Rusland verdwenen via Nederland’[1] [How billions disappeared from Russia via the Netherlands]. Already in 2017, mirror trading made the news in relation to the Deutsche Bank. But what is mirror trading? This article will first focus on the various forms of mirror trading before proceeding to the manner in which it can be applied in terms of money laundering schemes and which purpose it achieves. It starts by considering the scheme in view of the different phases of money laundering.

What is mirror trading?

Mirror trading takes place at international currency or stock markets. This trading method is not prohibited by definition. There are different varieties. In essence, mirror trading involves two opposite transactions, where bonds or shares are bought in one currency and sold in another. It is possible to make a legal profit, for example by trading on foreign exchange markets using exchange rate fluctuations. This is known as Forex trading (Foreign Exchange). The Forex market is the place where traders and investors buy and sell online currencies. It is one of the largest financial markets worldwide.

Mirror trading is sometimes also referred to as a method whereby an investor copies the strategy of another successful investor. Instead of opposing trade flows, these trade flows are exactly the same. This definition of mirror trading is not the subject of this article; the mirrored transactions of the sale and purchase of the same securities.

In addition to the aforementioned method of mirror trading using exchange rate fluctuations, it is also possible to use the scheme in another manner. The capital market is then used to transfer money from one jurisdiction to another. In so doing, the parties involved are then concealed or partly concealed. The opposite transactions proceed as follows.

One entity buys and the other entity sells the same number of financial instruments, at almost the exact same time, however in another currency. This creates the impression that the transaction is being carried out by two different parties. In reality, the economic owner of both components of the transaction is one and the same. It is difficult for the institutions that facilitate the trade to see that the different entities are in fact one and the same party.

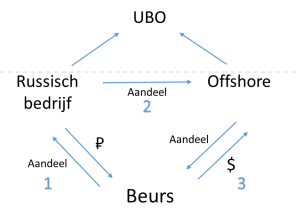

exchange – Share 1 – Share 2 – Share 3

The press describes examples in which Russian roubles are converted into dollars. A Russian company buys legitimate and inconspicuous securities on behalf of a client. A legal entity in an offshore jurisdiction, being jurisdictions that shield off owners, then sells the securities for dollars. Both trade flows seem to have nothing to do with each other, but in reality it involves one and the same interested party. As an end result, a currency exchange has taken place and money has been moved from the Russian company to the offshore company.

Mirror trading in money laundering schemes

Recent media reports regarding the FINCEN files emphasize that mirror trading can also be used in money laundering schemes. Period. What these media reports do not explain is how mirror trading can be used for money laundering purposes. Before we take a closer look at what the phenomenon of mirror trading can do for a money laundering scheme, we must first understand what the criminal wants to achieve with the money laundering process.

Money laundering means hiding and/or giving a seemingly legal status to an object gained through criminal means, so that it can be spent and invested in the upper world.

In other words, it involves money that was gained through criminal means, which must now obtain a seemingly legal status without arising suspicion. Literature on money laundering often refers to the so-called stages of money laundering. Money laundering is described as a process. The process of laundering money comprises the following steps: placement, layering, justification and expenditure, of which the third and fourth step are also commonly grouped together and referred to as integration.

The different phases do not have to follow each other chronologically, but can overlap. Nor do all stages have to be passed; this does not obstruct a possible conviction for money laundering.

Stage 1: Placement

The first step is placement. The objective is to get the (cash) money into the financial system. This can be done by depositing the money into a bank account. However, this will be a risky business considering the fact that large deposits of cash money do not go unnoticed. And getting noticed, is exactly the opposite of what the criminal wants. To reduce the risk of getting noticed, there is a placement technique called ‘smurfing’. Smurfing means splitting a larger amount into smaller amounts in order to stay just below the reporting threshold. This can be done for multiple accounts at different banks.

Stage 2: Layering

Next, the money is moved and/or complex schemes are being set up. This stage is called the layering stage. The money is split up, converted into other currencies, run through offshore companies, etc. The traceability of the criminal proceeds is made more difficult.

Stage 3: Legitimisation

The legitimisation or justification stage attempts to provide the criminal proceeds a seemingly legal status. If the money is noticed, it then appears as if there is a legitimate explanation for it, for example by false papers such as invoices or loans or so-called casino profits. The possibilities are endless, which is also why it so difficult to trace money laundering schemes.

Stage 4: Expenditure

In this stage of expenditure, criminals can spend the money that now appears to have been legally earned without giving rise to any problems, varying from the purchase of luxury items, making investments, etc. It is probable that not all of the criminal proceeds make it through to the end of the process. Money laundering also costs money, think of bribes, taxes and expenses for setting up companies or exchanging currencies. A cost item of about 20% is quite common.

This stage model provides insight into the main objectives of the criminal. The ‘movement of value’ runs across this model. The criminal in country A who wants to dispose of his criminal proceeds in cash in country B will have to move value. The criminal who wants to deposit his cash money in a Moldovan bank account because the banks are not that critical in Moldovia, will have to move value. The criminal who complicates the paper trail by channelling his criminally obtained money through the account of an offshore company with shielded UBO is moving value. Whether displacement is a means or an end, be that as it may for now, it may be clear that it is of the utmost importance in money laundering schemes.

Now we know what criminals want to achieve, we return to mirror trading and return to the image of the purchase of securities in roubles and the sale in dollars which was done practically simultaneously. Suppose the criminal starts this scheme with criminal proceeds, what will he or she achieve?

By using illegally obtained money to buy securities in roubles (or have them bought) which are then passed through the hands of multiple parties and sold in another country, after which the proceeds in dollars are channelled through multiple parties, including offshore companies, and finally deposited in a foreign bank account of the criminal, the criminal achieves the following:

- Obstructing the paper trail;

- Moving value;

- Converting currencies.

Disguising the proceeds from view may in fact be the most important aspect: if schemes make use of a network of dozens of letterbox companies with companies in high-level risk countries such as Cyprus and the British Virgin Islands, one can safely conclude that the scheme is aimed at concealing transactions and concealing the persons ultimately concerned.

That which is explicitly not achieved, may just be the criminal’s main objective: creating a legitimisation for the criminal proceeds so that it can be spent unhindered. The money still needs to be held in a shielded foreign bank account. The sale of securities cannot be linked to the criminal, and the purchase certainly cannot be linked to the criminal. After all, the scheme’s objective is to not be able to link the purchasing party and the selling party. How then does the criminal explain the value in his foreign bank account? And if a reference is already made to a sale of securities, how is the amount by which the securities were purchased legitimised?

In short, the deposit in the foreign bank account may finalize the phenomenon of mirror trading, criminals will still have to take the necessary steps to be able to make unhindered use of their money.

We realize that we are approaching the scheme from a theoretical point of view and as a whole. In practice, the gatekeepers involved will only see a small part of it. And even though there is no actual legitimisation, by making use of valid securities and renowned companies such as major banks and stock brokers for the trade, it does in fact create the illusion of legitimacy and the movement of value.

If there are any insights into the next steps following mirror trading that justify creating a justification for the money so that it can be used unhindered, please let us know by sending an e-mail to: AML.centre_postbus@belastingdienst.nl

[1] The Financieel Dagblad [The Dutch Financial Newspaper] ‘Hoe miljarden uit Rusland verdwenen via Nederland [How billions disappeared from Russia via the Netherlands]’ 21 September 2020, page 6.