Cash in rolled chicken meat

Publication date 24-04-2019

Overijssel Court, 13 February 2018, cash in rolled chicken meat: ECLI:NL:RBOVE:2018:421

The suspect has emerged during a money laundering investigation, aimed at co-suspects in Aruba. The investigation showed that the suspect spoke in veiled terms with co-suspect X about moving large amounts of cash. Subsequently in Aruba a sea container was seized in which a cash amount of €2,833,340 was found in boxes with chicken products. The sea container was shipped by company A, of which the suspect was the sole shareholder. When the suspect was arrested in Aruba he stated that he was not only involved in this money transport, but also in an earlier transport of €4,000,000. The money allegedly originates from co-suspect Y.

According to the court the transport of two large cash amounts justifies the suspicion of money laundering. Because of the way in which the money was transported (and the security risks involved) and because it is a well-known fact that various forms of crime involve large amounts of cash. The suspect did not give a statement explaining the origin of the cash. This means that the court reaches the conclusion that the amounts of money must originate from crime. According to the court the suspect laundered the two amounts of money, totalling €6,833,340.

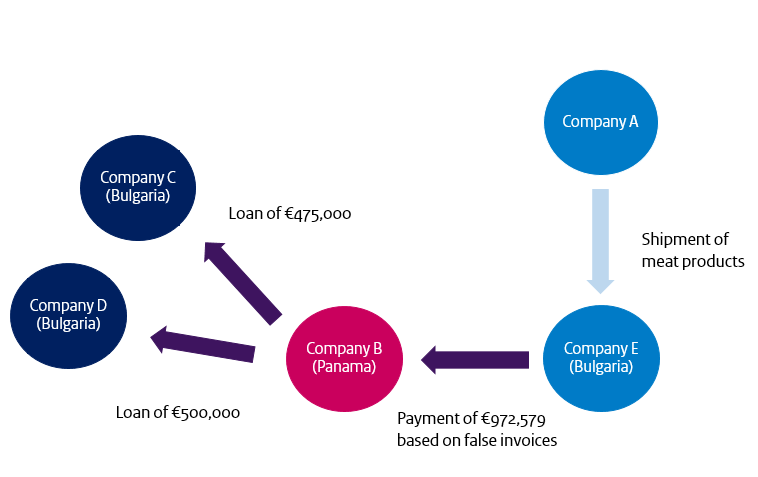

Among other things, the Public Prosecution Service also charged the suspect with laundering an amount of €975,000. According to the court, the case showed that company A supplied meat products to (among others) company E (established in Bulgaria). A part of the invoices, however, was issued in the name of company B (established in Panama). As a result, it seems as if company B supplied meat to company E, whereas the business accounts show that everything was supplied by company A. This means that the invoices (to the amount of €972,579) to company B are false and that the flows of money –therefore- originate from crime. Company B subsequently provided loans to the amount of €975,000 to companies C and D (both established in Bulgaria). This means possession and turning over of money originating from crime. The investigation shows that all the companies involved are affiliated with the suspect. Therefore, the court imputes all the acts between the companies to the suspect and as a result he is considered to be the perpetrator of money laundering.

Misuse of trade flows to move values may indicate trade based money laundering. Criminal money is moved internationally through trade and is given a seemingly legal origin. In this case it is unclear whether the €972,579 was criminal money or that it concerned a tax structure. The court dismisses that question and argues that the money had a criminal origin from the moment that company B paid company E as a result of false invoices.

The suspect is also convicted of laundering €309,000 and €17,000. Considering the duration and frequency of the acts the court is of the opinion that it concerns habitual money laundering.